Section 0: Module Objectives or Competencies

| Course Objective or Competency | Module Objectives or Competency |

|---|---|

| The student will be able to list and explain the objectives and outcomes of the feasibility study for the selection of system projects, and understand the importance of economic, operational, and technical feasibility. | Students will be able to select the most appropriate cost-benefit analysis approach for software development projects. |

| Students will be able to explain why a cost-benefit analysis may be performed at various stages of a system's development. |

Section 1: Overview

- Organizations must know comparative costs of the various system solutions in both hardware and software selection.

- Cost-benefit analysis is performed at various stages of a system's development.

- First performed during the feasibility study to compare various alternatives.

- Benefits alone have little meaning, but instead must be compared to the associated cost and time estimates.

- Systems analysts should take tangible costs, intangible costs, tangible benefits, and intangible benefits into consideration to identify costs and benefits of a prospective system.

Selecting the Best Alternative

To select the best alternative, analysts should compare costs and benefits of the prospective alternatives using some sort of capital investment analysis.

- Although most A&D textbooks include break-even analysis, payback analysis, and cash-flow analysis as suitable tools, they are not really appropriate.

- Net present value analysis – compares the value of a dollar today to the value of that same dollar in the future, taking inflation and returns into account. If the NPV of a prospective project is positive, it should be accepted. However, if NPV is negative, the project should probably be rejected because cash flows will also be negative.

- Internal rate of return – can be used to rank several prospective projects a firm is considering. IRR is the rate of growth a project is expected to generate. A project with a substantially higher IRR value than other available options will provide a much better chance of strong growth.

- Profitability index – allows an analyst to measure the proportion of dollars returned to dollars invested, and therefore allows the analyst to compare PV and initial investment on any number of investment opportunities: (Profitability Index = Present Value of all Future Cash Flows / Initial Cash Investment). Because the profitability index is not sensitive to the amount of the investment, the advantage of using profitability index to measure investment opportunities is that it allows the analyst to compare two investment opportunities that require different initial investments.

Section 2: Present Value Analysis

- Assess all the economic outlays and revenues of the information system over its economic life and to compare costs today with future costs and today's benefits with future benefits.

- Presents the time value of the investment in the information system as well as the cash flow.

-

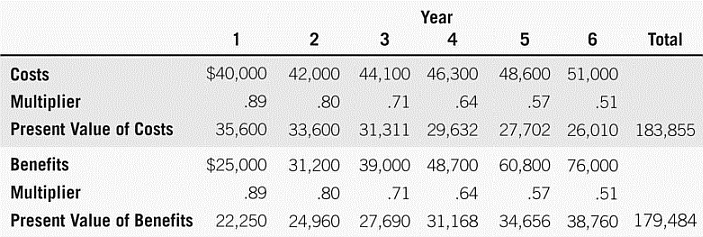

Example of Present Value Analysis

- Taking into account present value, the conclusion is that the costs are greater than the benefits.

- The discount rate, i, is assumed to be .12 in calculating the multipliers in this table.

- FIN 3315 provides a heavy dose of NPV.